Contact Us About Mergers & Acquistions

Please fill out this form to be contacted about a potential acquisition by or a merger with Marlin Steel

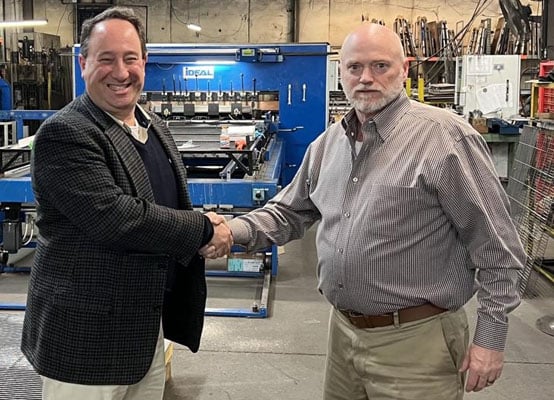

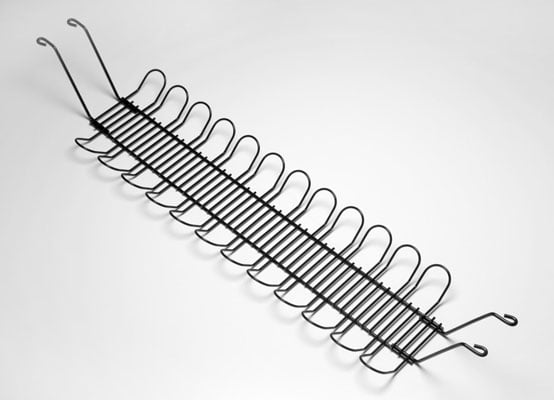

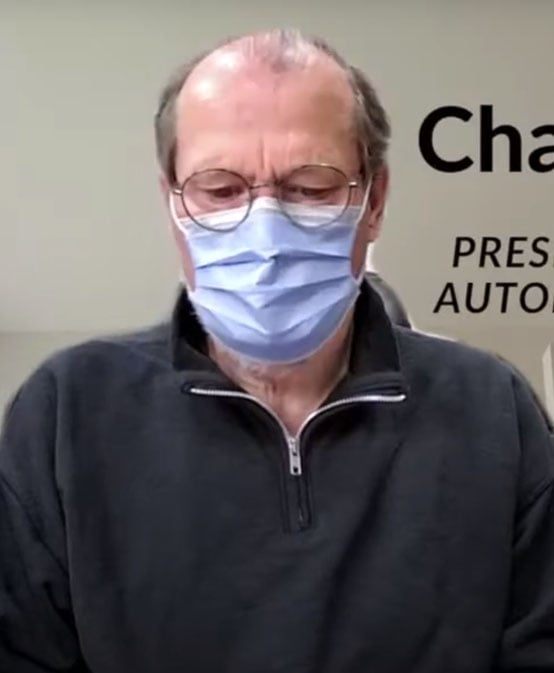

Responsible for shipping millions of pail and wire bucket handles all over the country and exporting to numerous overseas countries, Baltimore Automatic Wire Forming Corporation (BAWFC) is the oldest and largest manufacturer of handles in the United States. In November 2020, Owner and President, Charlie Jenkins, sold BAWFC to Marlin Steel for a new chapter of collaboration in the company’s rich history.

Marlin Steel had the privilege of interviewing Charlie Jenkins. Watch the video interview to learn about his experience during the acquisition with the Marlin Steel team.

Part of our strategy to serve our customers even better is driven by manufacturing company acquisitions. Ideal candidates are other manufacturing companies focused on Medical/Pharma or Aerospace within 1,000 miles of Orland, Indiana, Bronson, Michigan, or Baltimore, Maryland but any continental U.S. based manufacturing company will be considered, if there is a favorable alignment to our ongoing operations.

In accordance with the investment philosophy of its parent company, Marlin Steel’s approach is unique:

Unlike most private equity investors, Marlin Steel has no defined holding period for acquisitions; its preference is to work together forever.

Unlike most strategic buyers, the companies in which Marlin Steel invests will continue to operate independently with their current management team and culture intact.

Marlin maintains a long-term commitment to its acquired businesses and has not sold any of its holdings over the past 26 years.

If your company fits the Marlin Steel Wire Products profile, we’d like to hear from you. Fill out the contact form below or reach out to Gabrielle Silgalis, our Special Project Manager, via phone at 443-844-5214.

Please fill out this form to be contacted about a potential acquisition by or a merger with Marlin Steel

Translate This Page

Marlin Steel Wire Products

2648 Merchant Drive

Baltimore, MD 21230-3307

Phone (410) 644-7456

Fax (410) 630-7797